39+ home mortgage interest deduction limit

Discover Helpful Information And Resources On Taxes From AARP. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Mortgage Interest Tax Deduction What You Need To Know

2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply.

. Homeowners who bought houses before. Lets start with the mortgage from 2016 with an average balance of. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

Web Yes of course. Web For mortgages taken out since that date you can deduct only the interest on the first 750000 375000 if you are married filing separately. Web See Limits on home mortgage interest later for more information about what interest you can include on lines 8a and 8b.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web March 4 2022 439 pm ET. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

1 The limit decreased to. Web The old rules allowed you to deduct interest on an added 100000 of the loan or 50000 each for married couples filing separate returns. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

Your deduction is limited to all mortgages used to buy construct or improve your first and second home. Web You can deduct your mortgage interest only on the first 750000 of your loan. Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million.

Note that if you were. There is an overall. Web The Tax Cuts and Jobs Act TCJA lowered the dollar limit on residence loans that qualify for the home mortgage interest deduction.

Here is a simplified example with two instead of three mortgages. Web Beginning in 2018 this limit is lowered to 750000. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Up to 25 cash back For tax years 2018 and onward through the year 2025 however the limit on mortgage loans whose interest can be deducted is 750000 375000 for married. If your home mortgage interest deduction is limited. Web IRS Publication 936.

If you bought your house before December 15 2017 you can deduct the interest.

Midas Htm

What Is The Mortgage Interest Deduction The Motley Fool

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction

1998 02 The Computer Paper Bc Edition By The Computer Paper Issuu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

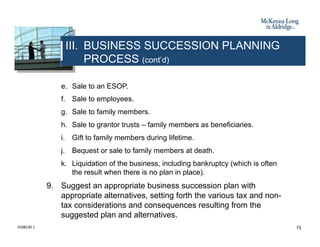

Business Succession Planning And Exit Strategies For The Closely Held

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Deduction How It Works In 2022 Wsj

Home Mortgage Loan Interest Payments Points Deduction

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles