Furniture amortization rate

Year 1 Depreciation 2 x 10 x 1000 Depreciation 20 x 1000 Depreciation 200 After year 1. Section 179 of the IRS tax code allows for the full deduction of the cost of purchasing business-related furniture with a limit of 1040000 or your business net income.

.png)

What Is Amortisation Amortisation Meaning

However keep in mind that because several underwriting factors affect final pricing actual interest rates may be higher or lower than what is listed below.

. Discover Why so Many Homebuyers Love PenFed ARM Loans. An amortization schedule calculator shows. The depreciation rate is used for accounting and tax purposes and the rules for the rate vary.

Create a free printable loan amortization table with this easy-to-use calculator. Discover Why so Many Homebuyers Love PenFed ARM Loans. 9 in quebec 100 rate for property available for use before 2024 plus an.

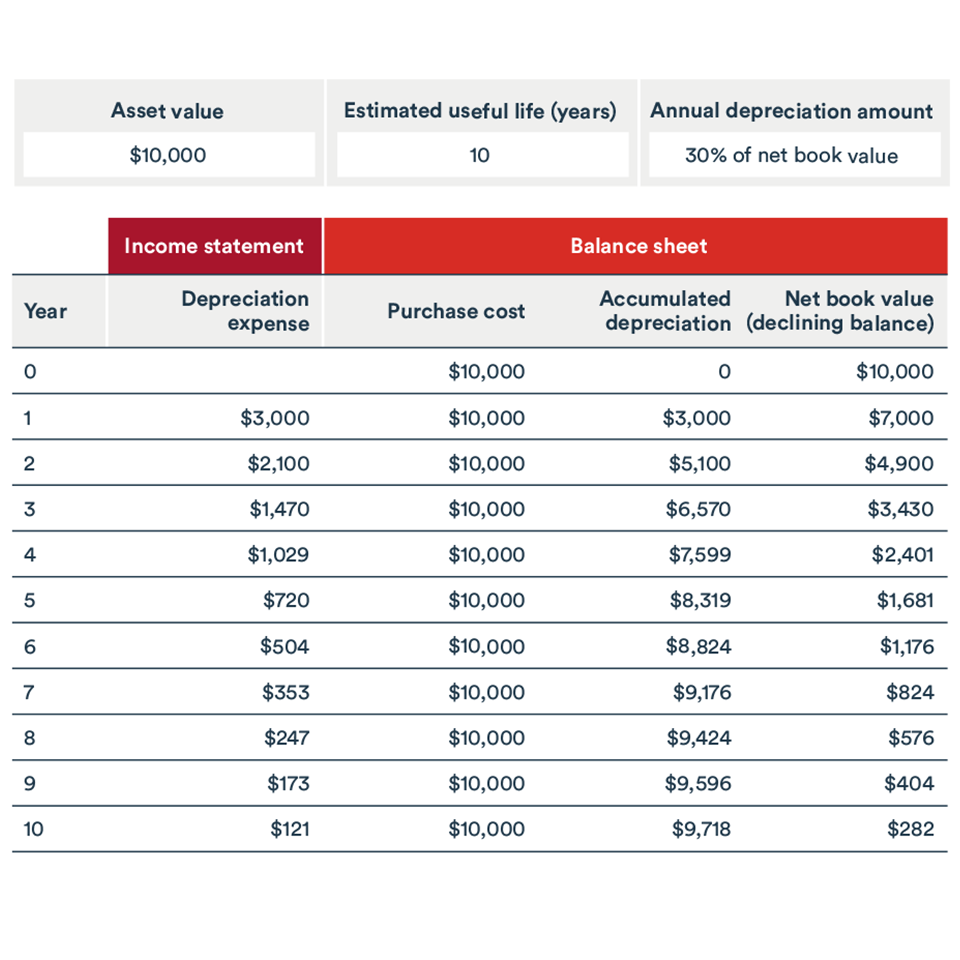

This asset will be used for 5 years. Mortgage Costs Comparison Guides. The depreciation rate of furniture refers to how furniture loses its value over time.

The information provided herein was obtained and averaged from a variety of. It also determines out how much of your repayments will go towards. Below we present the more common classes of depreciable properties and their rates.

Multiply 150000 by 3512 to get 43750. Class 1 4 Class 3 5. View the costs associated with a purchasing.

Ad Lock in a Low Interest Rate. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. How much principal and interest are paid in any particular payment.

In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and. Additional deduction in quebec equal to 30 of the capital cost allowance claimed in the previous year for new property. Ad Huge Savings on Furniture More.

Clearance Markdowns 0 Financing Offers Free Shipping. The amortization table below illustrates this process calculating the fixed monthly payback amount and providing an annual or monthly amortization schedule of the loan. We also list most of the classes and rates at CCA classes.

This represents the annual. Thats your interest payment for your first monthly payment. Ad Huge Savings on Furniture More.

In this example we use the same item of high-tech PPE purchased for 12 million with no residual value. How much total principal and interest have been paid at a specified date. Subtract that from your monthly payment to get your principal payment.

66 34 Principal Interest Annual Amortization Schedule Annual Schedule Monthly Schedule While the Amortization Calculator can serve as a basic tool for most if not all amortization. Brets mortgageloan amortization schedule calculator. Mortgage calculator - calculate payments see amortization and compare loans.

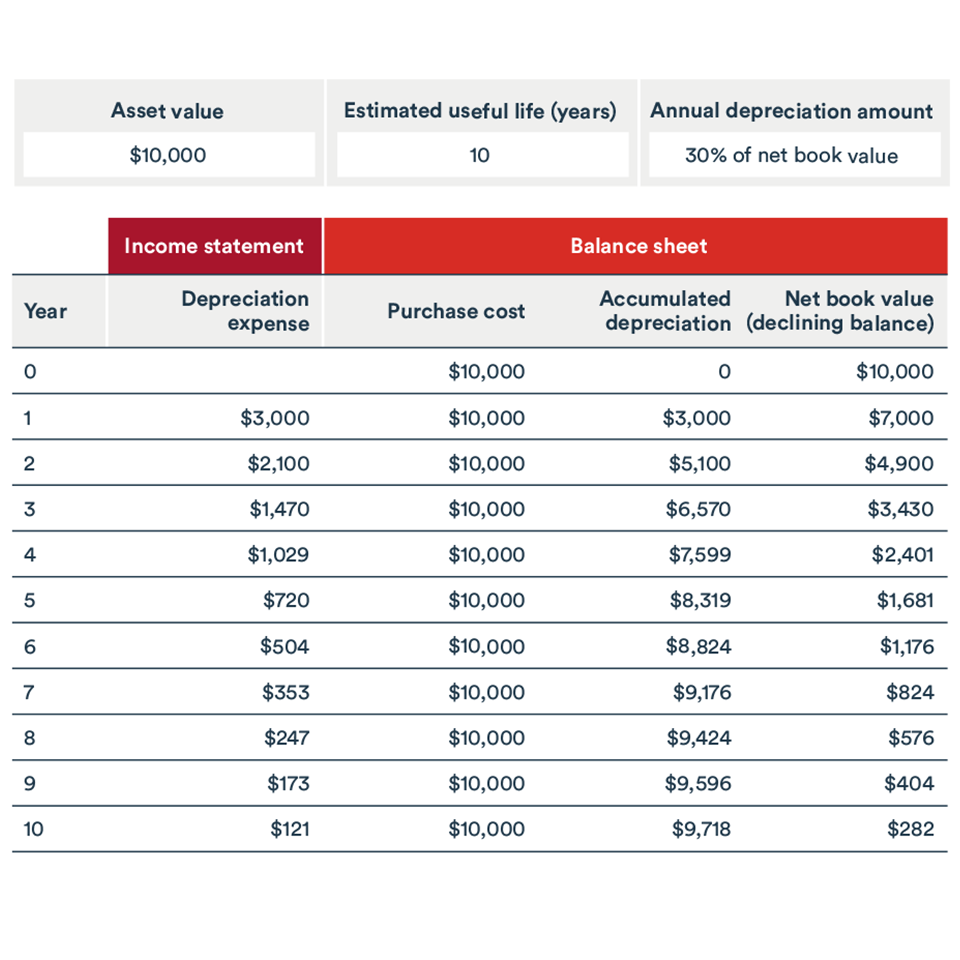

Since it is depreciated for 10 years the depreciation rate would be 10. The basic formula using straight line depreciation is purchase price less salvage value divided by the total number of years of useful life. An item that is still in use and functional for its intended purpose should not be depreciated beyond 90.

Clearance Markdowns 0 Financing Offers Free Shipping. Ad Lock in a Low Interest Rate. Calculate loan payment payoff time balloon interest rate even negative amortizations.

Depreciation Rate Formula Examples How To Calculate

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

Are Depreciation And Amortization Included In Gross Profit

An Update On Depreciation Rates For The Canadian Productivity Accounts

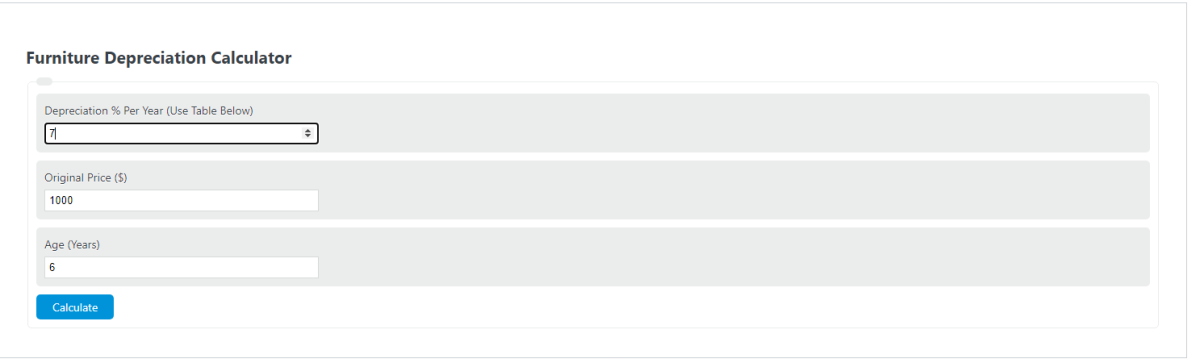

Furniture Depreciation Calculator Calculator Academy

An Update On Depreciation Rates For The Canadian Productivity Accounts

![]()

Furniture Calculator Splitwise

Furniture Fixtures And Equipment Ff E Definition

Depreciation Rate Formula Examples How To Calculate

Method To Get Straight Line Depreciation Formula Bench Accounting

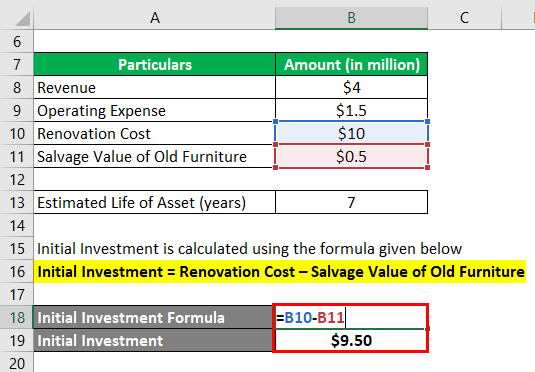

Accounting Rate Of Return Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

How To Calculate Depreciation Expense For Business

What Is Amortization Bdc Ca

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

Are Depreciation And Amortization Included In Gross Profit

An Update On Depreciation Rates For The Canadian Productivity Accounts

What Is Amortization Bdc Ca

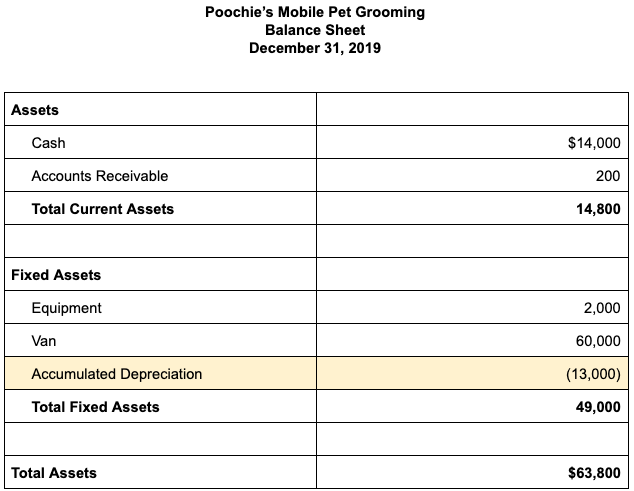

Accumulated Depreciation Explained Bench Accounting